Introduction

To help you get started with automated trading, we’ve compiled a list of 9 tips for success. These tips will help you choose the right software, optimize your settings, and protect yourself from scams. By following these tips, you’ll be well on your way to realizing the benefits of automated trading.

Before we dive into the tips, let’s first define what automated trading is and how it works. Automated trading uses software to interpret market conditions and automatically execute trades based on a set of predetermined rules. These rules can be as simple or complex as the trader desires, and can include factors such as the time of day, the asset being traded, and the direction of the trade (buy or sell). Automated trading can be performed on a variety of assets, including stocks, forex, commodities, and more.

1. Choose the Right Automated Trading Software

One of the most important decisions you’ll make when starting with automated trading is choosing the right software. There are many options available, so it’s important to do your research and choose a software that meets your needs. Here are some things to consider:

- Compatibility with your broker: Make sure the software you choose is compatible with your broker. Otherwise, you may experience connectivity issues or other problems.

- User-friendly interface: Look for software with a user-friendly interface that is easy to navigate. This will make it easier for you to set up and manage your automated trades.

- Helpful resources: Choose software that offers helpful resources such as tutorials, FAQs, and customer support. This will make it easier for you to learn how to use the software and get help when you need it.

It’s also a good idea to try out different software options using a demo account before committing to a particular one. This will allow you to see how well the software works and whether it meets your needs without risking any real money.

2. Use a Reliable VPS for Your Automated Trading

A VPS (Virtual Private Server) is a virtual machine that allows you to host your trading platform and run your trades remotely. Using a VPS can be especially beneficial for automated trading, as it ensures that your trades are executed even when your computer is turned off or not connected to the internet.

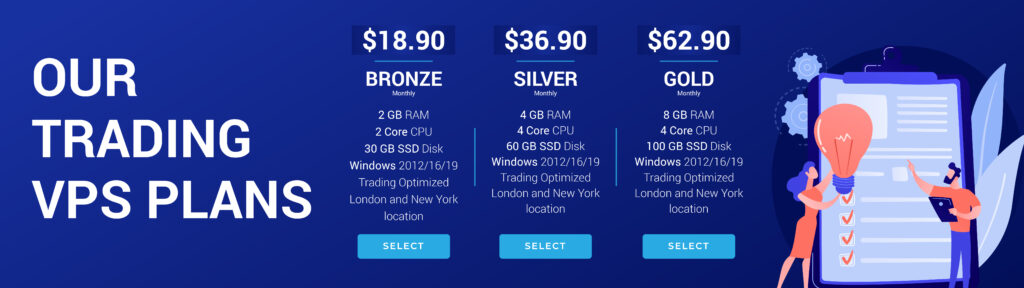

When choosing a VPS provider, look for one with low latency to the broker’s server and a high uptime guarantee. You should also consider the cost and the features offered by different providers, such as the amount of RAM, storage, and bandwidth included in the plan.

Keep in mind that using a VPS for automated trading comes with some additional responsibilities. You’ll need to ensure that your VPS is secure and that your trading platform and Expert Advisors are kept up to date. It’s also a good idea to regularly back up your VPS to prevent data loss in case of any issues.

One reliable VPS provider for automated trading is dipgate.com. With a focus on low latency and high uptime, Dipgate is a popular choice among traders looking for a stable and secure VPS solution. You can see all Dipgate’s benefits and VPS plans on www.dipgate.com.

3. Optimize Your Automated Trading Settings

To get the most out of your automated trading system, it’s important to optimize your settings. Here are some things to consider:

- Test your strategies: Before you start live trading, be sure to test your strategies thoroughly using a demo or backtesting. This will help you identify any weaknesses and make any necessary adjustments before risking real money. You can use tools such as backtesting software or a demo account to test your strategies and see how they perform under different market conditions. When testing your strategies, be sure to use a large enough sample size and a wide range of market conditions to get a true sense of their performance.

- Use appropriate risk management: Automated trading can be risky if not done correctly. Be sure to use appropriate risk management techniques such as setting stop loss orders and using a reasonable risk-to-reward ratio. It’s also a good idea to diversify your portfolio by using multiple strategies or trading different asset classes. This can help to reduce the overall risk of your trades. In addition, be sure to regularly review and adjust your risk management settings to ensure that they are still appropriate for the current market conditions.

- Consider your trade frequency: Too many trades can be just as harmful as too few. Determine the optimal trade frequency for your strategy and stick to it. Over-trading can lead to increased costs and lower profits, while under-trading can result in missed opportunities. Find a balance that works for you and your strategy. You can also use tools such as the Kelly Criterion to help you determine the optimal trade frequency for your account size and risk tolerance.

By optimizing your settings, you can increase the chances of success and minimize the risks of automated trading. Take the time to carefully consider your options and make any necessary adjustments to ensure that your automated trades are as profitable as possible.

4. Choose a Reputable Broker

When it comes to automated trading, the reputation of your broker is especially important. A reputable broker will provide you with a stable and reliable trading environment, as well as a wide range of trading tools and resources. They will also offer competitive spreads and fees, and provide you with the support you need to succeed in your trading.

Be sure to do your research and choose a broker that is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. This will ensure that your funds are protected and that you are trading in a transparent and fair environment.

It’s also a good idea to read online reviews and ask for recommendations from other traders before making your decision. This will give you a better idea of what to expect from different brokers and help you choose one that best meets your needs.

Two reputable brokers that offer a great selection of trading tools and resources for automated trading are RoboForex and IC Markets. Both brokers are regulated by top tier authorities and have a strong reputation among traders. Be sure to check them out and see if they might be a good fit for your automated trading needs.

For more information about the best automated trading software, be sure to check out our article: The Best Automated Trading Software.

5. Backtest Your Trading Strategy

Before you start using your automated trading strategy on live markets, it’s important to backtest it to see how it would have performed in the past. Backtesting allows you to see how your strategy would have fared under different market conditions and can help you identify potential weaknesses or areas for improvement.

To backtest your strategy, you will need to use historical price data and apply your rules to see how the strategy would have performed. There are several tools and resources available that can help you with this process, such as trading platforms with built-in backtesting functionality or dedicated backtesting software.

It’s also a good idea to test your strategy on a demo account before moving on to live trading. This will allow you to see how the strategy performs in real-time and make any necessary adjustments before risking your own capital.

By backtesting and testing your strategy on a demo account, you can gain greater confidence in your strategy and be more prepared for the unpredictable nature of live markets.

6. Set Realistic Expectations

It’s important to have realistic expectations when it comes to automated trading. While it can be a powerful tool for generating profits, it’s important to remember that no trading strategy is foolproof and there will always be some level of risk involved.

This means that you should never invest more money than you can afford to lose, and you should always have a well-defined risk management plan in place to protect your capital. This can include setting stop-loss orders or limiting your trade size to a certain percentage of your account balance.

It’s also a good idea to manage your expectations in terms of the potential returns you can achieve. While it’s possible to generate significant profits with automated trading, it’s important to remember that past performance is not indicative of future results and that there will be losing trades along the way. This is why it’s important to have a well-diversified portfolio and to not put all of your eggs in one basket.

By setting realistic expectations and managing your risk effectively, you can increase your chances of success with automated trading. It’s also a good idea to regularly review your performance and make adjustments to your strategy as needed to ensure that it continues to be effective.

7. Monitor Your Trades and Stay Up-to-Date

While automated trading can take care of the execution of trades on your behalf, it’s important to regularly monitor your trades and stay up-to-date with market conditions. This will help you identify any potential issues or problems with your strategy and allow you to make any necessary adjustments in a timely manner.

It’s also a good idea to stay informed about market news and events that could impact your trades. This can include economic data releases, political developments, or natural disasters. By staying informed, you can be better prepared for potential market moves and adjust your strategy accordingly.

In addition, it’s important to keep your software and trading platform up-to-date. This will ensure that you have access to the latest features and tools, and can help you avoid any potential issues or errors.

By monitoring your trades and staying informed, you can increase your chances of success with automated trading and make more informed decisions about your trades.

8. Use Caution with High-Risk Strategies

While high-risk trading strategies can potentially lead to higher returns, they can also lead to significant losses. This is why it’s important to use caution when considering such strategies, and to thoroughly assess the potential risks and rewards before proceeding.

If you do decide to use a high-risk strategy, it’s important to manage your risk carefully. This can include setting appropriate stop-loss orders, limiting your trade size, or diversifying your portfolio to reduce the impact of any potential losses.

It’s also a good idea to test the strategy on a demo account before using it with real money. This will give you a better idea of how the strategy performs in real-time and allow you to make any necessary adjustments before risking your capital.

By using caution and managing your risk effectively, you can minimize the potential risks of high-risk trading strategies and increase your chances of success.

9. Protect Yourself from Scams in Automated Trading

Unfortunately, the popularity of automated trading has also attracted a number of scams and fraudulent operators. It’s important to be aware of these potential risks and to take steps to protect yourself.

One common scam in the world of automated trading is the promise of unrealistic returns. If a company or individual claims that you can make exorbitant profits with little or no risk, it’s likely a scam. Remember that all investments carry some level of risk and it’s important to be realistic about the potential returns you can achieve.

Another red flag to watch out for is the pressure to deposit money quickly. Scammers may try to rush you into making a deposit before you have had a chance to fully research and assess the opportunity. Take your time and don’t feel rushed into making a decision.

You should also be wary of companies or individuals that are not transparent about their operations. A legitimate business will typically provide clear and detailed information about their services, fees, and terms and conditions. If this information is difficult to find or unclear, it’s a potential sign of a scam.

To protect yourself from scams in the world of automated trading, it’s important to do your research and be cautious of any company or individual that seems too good to be true. Look for reviews, testimonials, and regulatory information, and don’t be afraid to ask questions and get clarification on any issues or concerns you may have.

Conclusion

Automated trading can be a powerful tool for generating profits, but it’s important to approach it with caution and to be well-informed about the potential risks and rewards. By following the tips outlined in this article, you can increase your chances of success with automated trading and protect yourself from potential scams and fraudulent operators.

We hope you found this article helpful and that it gives you a good foundation for your journey into the world of automated trading. Good luck and happy trading!

Boost Your Trading Success! Explore Our VPS Plans

© Dipgate