Introduction

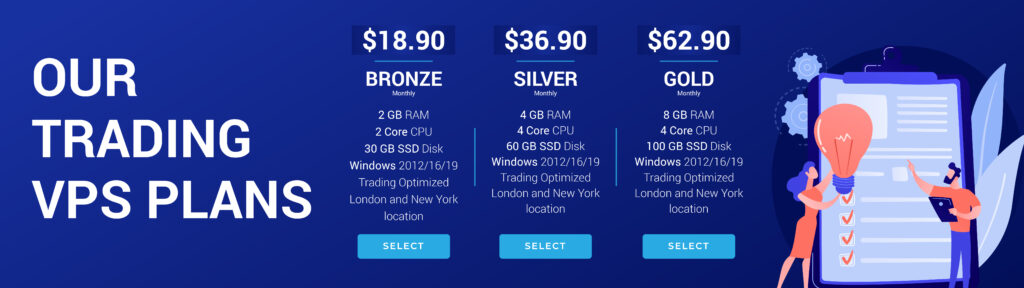

In the world of Forex trading, the use of automated trading robots has become increasingly popular. Trading robots, also known as Expert Advisors (EAs), allow traders to automate their trades and strategies, helping to eliminate the time-consuming tasks of manual trading. With the assistance of a Forex VPS (Take a look to our VPS Plans), traders can run their EAs continuously, even when their computers are offline. This ensures that the robots are always working for you, even when you’re not watching the markets.

One common challenge that traders face when using automated trading robots is setting them up to perform optimally. Incorrect settings can lead to inaccurate trading decisions, higher costs, and reduced profits. This article will discuss crucial aspects of optimizing your trading robot settings to perform effectively on your Forex VPS.

Understanding Your Trading Robot’s Capabilities

Before diving into the optimization process, it’s crucial to understand the capabilities of your trading robot. Every EA is designed differently, boasting unique features and specific strategies. Research your robot’s key functionalities and abilities, focusing on its potential strengths and weaknesses. Take note of the following:

- Trading algorithm: Gaining insight into the trading algorithm is essential for understanding how your robot makes decisions. This knowledge will allow you to optimize settings that align with your trading goals and risk tolerance.

- Timeframe and currency pairs: Knowing which timeframe and currency pairs your trading robot is designed to perform best will help you focus on optimizing the settings within the most relevant parameters.

- Risk management features: Your trading robot may have built-in risk management features such as stop-loss, trailing stop, etc. Understanding these features will help you set up your EA to protect your capital and secure profits while avoiding potential catastrophic losses.

- Customizable settings: Some EAs come with a more comprehensive range of customizable settings that allow you to fine-tune specific aspects of the trading strategy. Being familiarized with these customizable settings is essential when working on optimization.

By learning the ins and outs of your trading robot, you can make more informed decisions when adjusting its settings to meet your specific trading objectives.

Testing and Optimization Techniques

Optimizing your trading robot’s settings can involve a variety of testing and optimization techniques. In this section, we will explore the most common methods that traders utilize to fine-tune their EAs.

1. Backtesting: Backtesting is the process of testing how the trading robot would have performed based on historical market data. This method helps to analyze the robot’s trading strategy and determine whether it is profitable under past market conditions. Many trading platforms, such as MetaTrader, offer integrated backtesting tools. When backtesting, ensure that you have high-quality, accurate historical market data and the specific parameters of the EA under test.

While backtesting provides valuable insights, it’s crucial to recognize that past performance is not necessarily indicative of future results. Market conditions are ever-changing, so it’s essential to combine backtesting with other optimization approaches.

2. Forward testing: In contrast to backtesting, forward testing involves evaluating the trading robot’s performance in real-time market conditions using a demo account. This method helps to determine the EA’s performance and reliability in the current market environment. It is especially useful when backtesting results are insufficient or not dependable. Forward testing should be performed for an adequate period to ensure that the trading robot performs well across various market conditions.

3. Optimization within MetaTrader: MetaTrader’s Strategy Tester is a powerful tool that allows traders to optimize their trading robots automatically. The tool scans and tests the combinations of different parameters to find the best-suited settings for your EA. When using MetaTrader’s optimization tool, be cautious of over-optimization. Over-optimization occurs when a trading robot is fine-tuned excessively based on historical data, which will impair its performance on new data. To avoid this issue, perform optimization within reasonable bounds and always validate the findings by using forward testing.

For more information about the best automated trading software, be sure to check out our article: The Best Automated Trading Software.

Key Factors to Consider When Optimizing Your Trading Robot

Optimizing your trading robot is an ongoing process involving regular evaluation and adjustment. Here are some key factors to consider when optimizing your trading robot settings:

1. Profitability: The primary goal of optimization is usually to maximize profitability. Keep an eye on your trading robot’s performance metrics, such as profit factor, expected payoff, total net profit, etc. These metrics will help you quickly assess whether the optimization has improved its overall profitability.

2. Risk-reward ratio: Striking a balance between risk and reward is vital in trading. Ensure that your trading robot is achieving an acceptable risk-reward ratio. This balance will vary depending on your risk tolerance and trading goals. Be wary of settings that generate high profits but come with an increased risk of substantial losses.

3. Drawdowns: Drawdowns are an inevitable aspect of trading that measures the reduction in your account from peak to trough. Your trading robot should be able to manage and minimize drawdowns effectively. Monitor the robot’s settings to ensure that it is not overly exposed to market fluctuations or trades that result in significant drawdowns.

4. Consistency: Consistency is critical for long-term trading success. Evaluate your trading robot’s performance consistently to ensure that it remains profitable over an extended period. Consider the win rate, average trade duration, and the number of trades executed during the testing phase to gauge consistency.

5. Trade frequency: Your trading robot’s trade frequency may affect its profitability. High-frequency trading robots may capitalize on smaller price movements, but they also potentially incur higher transaction costs due to increased trading volume. Conversely, low-frequency trading robots may miss opportunities due to less market activity. Adapt your trading robot’s settings to find the right balance between trade frequency and profitability.

Conclusion

Optimizing your trading robot settings is essential for maximizing the potential of your Forex VPS setup. By understanding the capabilities of your trading robot, utilizing effective testing and optimization techniques, and being mindful of the key factors mentioned above, you can enhance the performance of your EA and improve your overall trading results.

Remember that optimization is an ongoing process that requires regular assessment and fine-tuning to adapt to changing market conditions and personal trading objectives. Stay diligent and committed to this process to make the most of your automated trading journey.

Watch our different trading VPS plans.

© Dipgate