Automated trading software can be a powerful ally for traders, allowing them to save time and effort by automating their trades and focusing on other tasks. But with so many different options available, it can be overwhelming to choose the best one for your needs.

In this article, we’ll explore the key factors to consider when choosing automated trading software, including reliability, user-friendliness, compatibility with your trading strategy and goals, and available features such as technical analysis tools, news feeds, and customization options. We’ll also delve into ease of use and level of customization, as well as the cost of different software options.

By the end of this article, you’ll have a clearer understanding of what to look for in automated trading software and be better equipped to make an informed decision about the option that’s right for you. So let’s get started!

Features to Consider

Reliability

One of the most important factors to consider when choosing automated trading software is reliability. You want a software that is going to work consistently and accurately, without any unexpected glitches or downtime.

Look for software that has a proven track record of reliability, as well as customer support that is available to help you troubleshoot any issues that may arise. It’s also a good idea to read reviews and ask for recommendations from other traders to get a sense of the software’s reliability.

User-friendliness

Another important factor is user-friendliness. You want software that is easy to navigate and understand, with a clear and intuitive interface. Complex or confusing software can be frustrating to use and may even discourage you from using it. Look for software with a user-friendly interface, as well as clear documentation and resources to help you get started. If possible, try out the software yourself or look for demos or trial versions to get a feel for how it works.

Compatibility with Your Trading Strategy and Goals

It’s also important to choose software that is compatible with your trading strategy and goals. Different software may be better suited for different types of trading or for certain markets or assets.

Think about what you want to achieve with your trading and look for software that supports those goals. For example, if you’re interested in long-term investments, you may want software that offers technical analysis tools and news feeds to help you make informed decisions. On the other hand, if you’re more focused on short-term trades, you may want software with fast execution speeds and real-time data feeds.

Available Features

In addition to compatibility with your trading strategy and goals, you’ll also want to consider the available features of different software options. Some software may offer a wide range of technical analysis tools and customization options, while others may be more basic.

Think about what features are important to you and look for software that offers them. Some options to consider include:

- Technical analysis tools such as charting software and indicators to help you analyze market trends and make informed trades

- News feeds to keep you up-to-date on market events and trends

- Customization options such as the ability to set your own trade rules and parameters

Of course, keep in mind that more features may also mean a higher price tag. Weigh the importance of different features against your budget to find the right balance for you.

For more in-depth information on finding the right software for your needs, be sure to check out our article: “What to consider when choosing the right VPS for Automated Trading”.

Considerations for Choosing the Right Software

When it comes to choosing the right automated trading software, there are several key factors to consider. These include compatibility with your trading strategy and goals, user-friendliness, available features, and reliability. Let’s take a closer look at each of these considerations.

Compatibility with Trading Strategy and Goals

It’s important to select software that is compatible with your trading strategy and goals, as well as your level of experience. If you are a beginner trader, you may want to opt for software with a user-friendly interface and clear documentation. More advanced traders, on the other hand, may need software with more advanced features and customization options.

For example, if you are a beginner trader looking to test out different strategies and see which one works best for you, you might want to opt for software that offers a range of technical analysis tools and customization options. On the other hand, if you have a specific trading strategy that you want to automate, you’ll need software that is compatible with that strategy and offers the necessary features and customization options.

User-Friendliness

Ease of use is another important factor to consider when choosing automated trading software. You want to choose software that is intuitive and easy to navigate, especially if you are a beginner trader. Look for options with a user-friendly interface and clear documentation, as these will make it easier for you to get started and start making trades.

Available Features

The available features of the software are also an important consideration. Some key features to look for include technical analysis tools, news feeds, and real-time data feeds. These can be invaluable resources for making informed trades and optimizing your strategy.

For example, technical analysis tools can help you analyze market trends and make more informed trades. News feeds can keep you up to date on the latest market news and events, while real-time data feeds can provide you with live updates on market conditions.

Reliability

Finally, reliability is crucial when it comes to automated trading software. You want to choose software that is reliable and has a good track record of success. Look for options with a solid reputation among users and a history of performance. You should also consider the cost of the software, as well as any ongoing fees or subscriptions. It’s important to carefully weigh the costs and benefits of different software options to ensure you are getting the best value for your money.

In terms of reliability, it’s also a good idea to do your own research and read reviews from other users. This can give you a better understanding of the software’s performance and any potential issues you may encounter.

Cost and Ongoing Fees

In addition to reliability, it’s important to consider the cost of the software and any ongoing fees or subscriptions. Some software options are free to use, while others come with a one-time fee or ongoing subscription cost. It’s important to carefully weigh the costs and benefits of different software options to ensure you are getting the best value for your money.

For example, if you are a beginner trader looking to test out different strategies, you may want to opt for a free or low-cost software option. On the other hand, if you are a more advanced trader with a specific trading strategy that you want to automate, you may be willing to pay more for software with advanced features and customization options.

Conclusion

In this article, we’ve covered the key considerations for choosing the best automated trading software, including compatibility with your trading strategy and goals, user-friendliness, available features, and reliability. We’ve also highlighted some top picks in the market, including MetaTrader, TradeStation, and eToro.

As you consider your options, it’s important to try out different software and find the one that works best for you. Don’t be afraid to test out different strategies and see what works best for your trading goals. With the right software, you can improve your trading performance and increase your chances of success in the market.

It’s also important to remember the other factors that can impact your trading success, such as choosing the right forex VPS and using effective trading strategies. For more tips and advice on successful automated trading, be sure to check out our article on 9 Tips for Successful Automated Trading.

We hope this article has been helpful in your search for the best automated trading software. With the right tools and strategies, you can take your trading to the next level and achieve your financial goals.

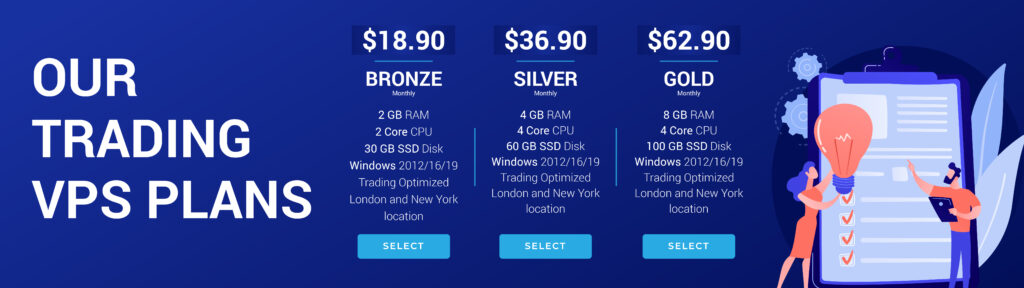

Boost Your Trading Success! Explore Our VPS Plans

© Dipgate